MIAMI – U.S.-based marine chassis lessor, American Intermodal Management (AIM), along with portfolio company I Squared Capital, is now merging with FlexiVan Leasing, as announced January 27th. FlexiVan is owned by Castle & Cooke and is the third largest marine chassis provider in the country, with its 300 employees and over 120,000 chassis.

“I Squared Capital is expanding its global presence across the transportation and logistics value chain with approximately $2.2 billion of equity capital committed across North America, Europe, and Asia,” said AIM Board chairman and I Squared Capital Managing Partner, Adil Rahmathulla. “We are now a leader in trailer and chassis leasing across Europe, Canada, and the U.S. as well as the largest private owner of highways in India.”

AIM currently operates 12,500 chassis, and will reach a combined fleet of 137,500 with FlexiVan.

“This transaction combines FlexiVan’s 65 years of operating history, nationwide presence, and deep customer relationships with AIM’s fleet of new chassis, innovative technology. and data analytics to offer our customers more flexibility and great supply chain efficiency,” said AIM CEO and CEO of the new combined company, Ronald Widdows.

The business will continue to be called FlexiVan, a name originating from the mid-1950s when trucking executive Malcolm McLean helped to develop the first standardized intermodal shipping container.

As for AIM, the company was formed by I Squared in 2016 as a logistics platform, and has become a leading chassis lessor. AIM provides GPS-enabled services to other companies, shipping lines, and retailers throughout the country’s intermodal supply chain, and currently has the innovative technology options to work with FlexiVan’s relationships and deploy its tech-enabled model throughout the U.S.

“This is our fifth acquisition in the transport and logistics sector in the last six months, and [is] a key milestone as we expand our presence in the U.S. market,” explained Rahmathulla.

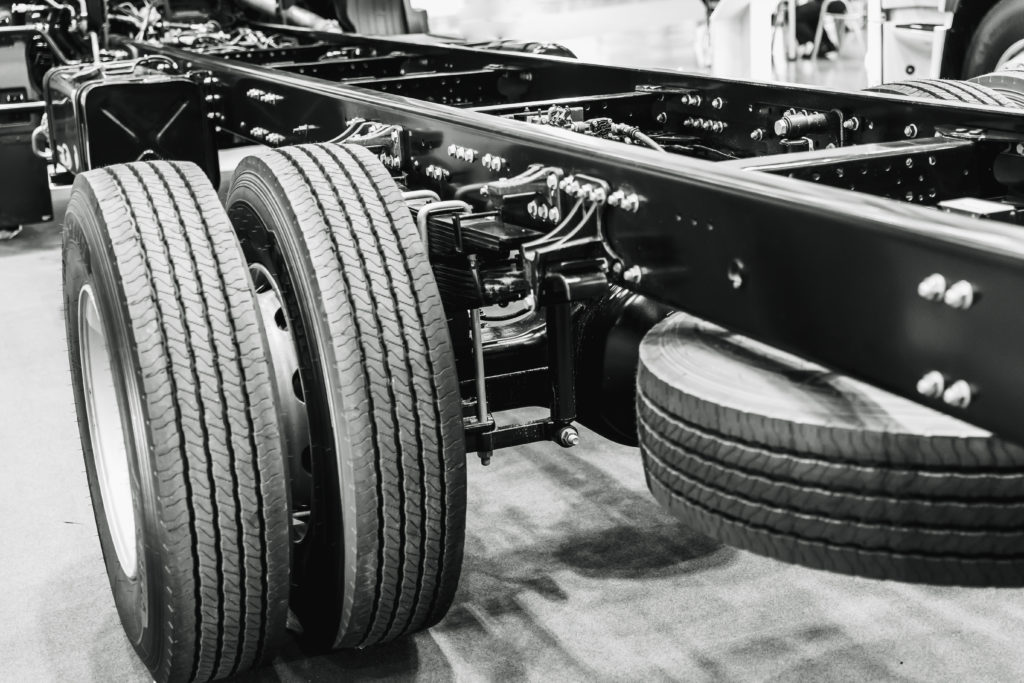

AIM is a young business and has many of the highly sought-after technologies trucking companies are searching for lately–such as LED brake lights, automatic braking systems, and radial tires. Each AIM chassis has a GPS sensor, an accelerometer that transits distance, speed, and direction, and a load sensor that can communicate when a container is mounted and dismounted.

As FlexiVan acquires AIM’s chassis fleet, it will no longer need to purchase thousands of new chassis from China International Marine Containers, the industry’s leading manufacturer. Importing from the overseas company brought up the issue of tariffs–which will no longer be an issue for FlexiVan, as its chassis from AIM will last for up to 25 years.

Additionally, until this announcement, AIM had been shut out of multiple terminals because it had not established relationships with ocean carriers and terminal operators–which control which chassis are used. Now, it should be welcomed at most ports.

“AIM as an upstart–they didn’t have any of those legacy relationships or contracts, and they were being essentially left out of some business,” said director of transportation consulting with IHS Markit, Paul Bingham. “That’s because their equipment wasn’t able to be used at some specific terminals. This deal breaks down the walls, at least for AIM getting onto the terminals where the acquired company has operations now, so it expands where their fleet can reach, and the merged company will have more opportunities.”

FlexiVan currently works with all major chassis pools, and has current agreements with many large container shipping companies, like OOCL and Ocean Network Express.

“The combination of AIM and FlexiVan will provide strong financial support to continue the upgrade of FlexiVan’s fleet, support significant investment in new assets, and fund ongoing development of innovative IT systems, all of which will allow us to deliver an industry-leading customer experience,” said Charlie Wellins, FlexiVan president.

However, Bingham said it is not guaranteed chassis customers will see an immediate significant change.

“I really don’t know if it is going to fundamentally revolutionize anything, because it’s still not moving the industry to where it’s the actual truckers owning the chassis, like it is in the rest of the world,” he explained. “The issues revolve, as they always have, around maintenance…This particular merger is a change of some of the leadership, but I’m not sure where it’s going to go in terms of management.”

Reader Interactions