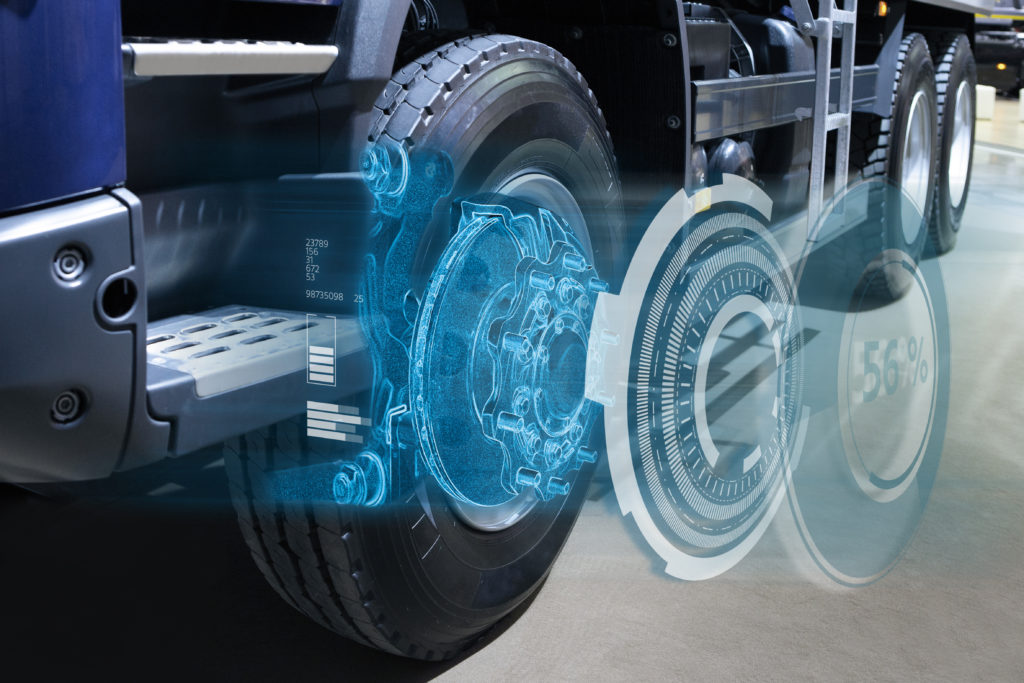

Ike Robotics, Inc. has been using a unique approach to developing and preparing its self-driving commercial trucks for market; however, there are growing concerns that such testing may be far too little to prove truly “safe.” Many have heard the horror stories of self-driving vehicles being tested on the road and the severe risks associated with such tests. The reality is that the companies releasing self-driving functions in their vehicles are doing so at a slow pace as they already know the roads are not quite ready to handle fully autonomous vehicles. For instance, what happens when a vehicle quickly cuts off another driver, or happens to try and dodge a pothole causing them to swerve slightly over the lane? While it is clear that self-driving vehicles have the ability to learn from simulations and situations that occur on the road while the vehicles are driving, there seems to be an issue as to whether testing such vehicles on public roadways is the proper thing to do. These are the exact factors these companies are having to consider to ensure that another Tesla mishap or uber autonomous car incident does not occur. Instead, we have seen auto manufacturers releasing impressive high-tech safety functions for their vehicles, including commercial trucks. Recently, Volvo announced it would be implementing a new driver assistance system that has the ability to automatically press a vehicle’s brakes at a much higher speed under circumstances that would have typically led to a collision. And that’s where the news of Ike’s safety tests for its state-of-the-art trucks comes into play.

Ike recently produced a 90-page safety report it provided to the National Highway Traffic Safety Administration (NHTSA) which outlined that its process for testing was done solely on “simulation and private-track testing,” wrote Automotive News, a newspaper covering the trends of the industry. In addition, the publication reported that Ike’s safety report was the “16th the federal agency has received from industry players and perhaps the first from a company that has yet to test its technology on public roads.” What this shows is that the self-driving technology we continue to hear about in the news from the likes of Tesla and other manufacturers is quickly becoming widespread even though there are already a growing number of concerns surrounding its use. Although Ike’s belief and decision to not test vehicles on the road is understandable and will likely prevent more collisions from occurring in the testing phase, how much “safer” is it to actually withhold testing on roads? It appears that at this time, unfortunately no one really knows, with Volvo’s own executive claiming in July that “measuring progress by miles was ‘a myth,’” stated Automotive News. Although an automobile manufacturing giant such as Volvo certainly has a track record of success in the industry, the reality is that many of the companies involved in actually testing these vehicles happen to be startups similar to Ike. The key word there is “startup.” Unfortunately, while Ike may believe that it is safer for its company to test on a track and under a variety of simulations, it could also be the fact that the company and other startups in this industry do not have the proper amount of funding to actually place a fleet of trucks on the roads for testing. The technology alone for these trucks costs millions of dollars, so for a startup banking on huge success and having to prove themselves to continue gaining the proper funding, this may be something the industry needs to keep a close eye on.

One good sign that startups like Ike may actually be close to bringing safe commercial trucks to the road is the fact that prominent manufacturers of vehicle safety equipment are entering agreements to be suppliers for their trucks. As of October 30, 2019, Ike announced it had selected Ouster, a leading manufacturer of high-resolution lidar sensors used in autonomous vehicles, to be its primary supplier for its fleet of autonomous trucks it plans to roll out. The press release went on to state, “Ouster and Ike share a commitment to commercializing safe, impactful technology by focusing on practically-minded product development.” The hope is that the more autonomous vehicles become a regularity on the road, clearly beginning with non-commercial vehicles, the easier it will be for more companies to continue become the suppliers of these up-and-coming automotive manufacturers. The issue that we clearly see at this time; however, is the reality that these startups are unlike anything we have ever seen. Sure, we often hear about new tech startups in Silicon Valley, but does function potentially place millions of individuals at a physical safety risk like an autonomous vehicle would? This is not to say that autonomous vehicles, especially trucks are not a possibility, but the reality is that there are millions of miles of roads in the United States and each one is going to offer a different scenario for these autonomous trucks to respond to. All in all, safety and ensuring that this next step in technology doesn’t hinder other drivers on the road should be our absolute worry in this stage of the evolution of the trucking industry.